Entering a Voluntary Payment Plan with Your Creditor After Being Served with a Lawsuit May Not Be Your Best Solution

The pandemic has caused financial turmoil for many people. Many Pennsylvanians find themselves behind on payments whether it be on their credit cards, personal loans, medical bills, or with their mortgage company. As Pennsylvania re-opens and recovers from the pandemic, creditors will continue collection efforts to take advantage of consumers who have found themselves hurting financially. Individual saving has reached an all-time high, but that does not mean an individual should use that money to enter a voluntary payment plan with the creditor. https://www.wsj.com/articles/americans-are-saving-more-but-how-long-can-it-last-11591272180 Gas prices are on the rise and the cost of goods are increasing and that money may be needed for necessities in the future. Creditors are trying to capitalize on the government economic impact payments or commonly referred to as stimulus payments. Their hope is that their continued collection efforts lead to you, the consumer, entering a payment plan with them. The creditor may continue to call you, send letters, or do anything else possible to get you to contact them. The last step they take is filing the lawsuit against you. Many people get served with this lawsuit and call the creditor to enter a voluntary payment plan. These payment plans typically are for a small dollar amount per month for a large number of months until the amount owed is paid in full. For instance, someone allegedly owes $6,000 dollars to their credit card company. They receive a lawsuit seeking to recover that amount of money. A consumer calls the credit card company and says they can make $100 a month payments. The credit card company says that is fine we will secure the settlement amount with a consent judgment, and you can make your $100 dollar a month payment until the $6,000 dollars is paid in full. Many consumers are happy to take care of the immediate problem by only paying $100 a month. The consumer does not realize they will be making that payment as part of their monthly budget for five years! Should something happen in that time frame and a payment is missed, then the creditor will have a judgment against the consumer. This judgment could lead to attempting to garnish a bank account and/or seizing the individual’s assets as well as having a lien against any property owned. Voluntary payments to creditors seem like a good solution. However, they are only a short-term solution. Consumers usually end up paying back a lot more than they should. If you hire Harold Shepley & Associates, then you have experienced attorneys to effectively handle your financial situation. We work to obtain the best deal possible for you and save you a significant amount of money. Most importantly, we offer a long-term solution to a consumer’s financial situation in a time frame that works for the consumer. If you find yourself needing help financially, call Harold Shepley & Associates. We can evaluate your circumstances and advise you on the best course of action to save you the most money to help you reach a long-term solution. Call our office today for a FREE consultation at 1-877-827-9006. The information provided in this article does not, and is not intended to, constitute legal advice; instead, all information, content and materials available in this article are for general information purposes only. No attorney-client relationship is established between the reader, user or browser and the website owner, author contributors, or respective law firm employees by using, viewing, browsing, or clicking on the link to this article or related links.

Job Loss Does Not Mean You Will Lose Your Home – If You Plan Carefully

Losing your job after years of employment and enjoying a steady paycheck is a shock to anyone. Unemployment compensation does not replace the regular paychecks you previously received. This may be the very situation workers at the US Foods facility in Altoona, Pennsylvania will experience with reports that its warehouse operations will soon close. When a sudden change in employment and income occurs, many people do not consider that an immediate change to the household budget is required. It is critical to place the immediate needs of the family and purchases of the absolute necessary items at the highest priority to prepare the family until new, replacement employment can be found. Unnecessary household purchases must stop, and cash must be saved for emergencies to stretch the household budget as far as possible. Mortgage payments, automobile payments, insurance and utilities are key expenses that you must consider when preparing a new budget and recovering from a loss of employment. In some cases, you may need to choose between paying for the necessities to maintain a residence and meet the needs of your family or pay credit card bills, medical debts, and other similar expenses. If you simply cannot afford to pay for the necessities and provide some payment to the credit card companies or medical providers each month, then bankruptcy relief can be an option. Bankruptcy relief is an option that many people fail to consider as they plan and develop a new budget following a loss of employment. The benefits that bankruptcy provides should not be overlooked. Contact Harold Shepley & Associates before you decide to invade your savings accounts and retirement accounts. Every family faces unique circumstances and planning to use bankruptcy relief can be complicated. Harold Shepley & Associates can help you evaluate your circumstances and advise you if bankruptcy relief can help you reach your goals. Call our office today at 1-877-827-9006. The consultation is FREE. The information provided in this article does not, and is not intended to, constitute legal advice; instead, all information, content, and materials available in this article are for general informational purposes only. No attorney-client relationship is established between the reader, user or browser and the website owner, author, contributors, or respective law firm employees by using, viewing, browsing, or clicking on the link to this article or related links. This website and article may contain links to other third-party websites. Such links are for the convenience of the reader, user, or browser; Harold Shepley & Associates, LLC its members and staff do not recommend or endorse the contents of the third-party sites. Readers of this article should contact legal counsel to obtain advice with respect to any legal matter in their respective jurisdiction. We are a debt relief agency. We help people file for bankruptcy relief under the Bankruptcy Code.

How to Avoid Bankruptcy

It’s Not Too Late! The best way to avoid bankruptcy is with good money management, setting a budget and simply not spending more than you earn. Of course, we realize you are probably reading this article because you are already at a point of desperation. Perhaps our title should be: How to Avoid Bankruptcy When I’m Already in Trouble? You Can Avoid Bankruptcy with Several Steps When you are delinquent on your accounts, it is usually due to negative cash flow. You are spending more than you are making. There are a few basic remedies: Make more money Reduce expenses Try a mix of both For those who are able, avoiding bankruptcy may entail getting a second job as well as reducing expenses. We know it’s not easy. Reducing expenses can be difficult. Start by separating your wants from your needs. It is easy to point out vices like cigarettes, alcohol, and gambling. The harder part is when you need to cancel your cable or internet. Often you need to determine just how desperate your situation has become and decide whether something that once was a “need” is now simply a “want.” Losing cable and internet services is one thing, but what about your second vehicle? It may be a great convenience, but when push comes to shove can you and your spouse survive with just one vehicle? Avoid Solutions that Dig Debt Deeper Sometimes people avoid bankruptcy by taking a loan against their 401k or IRA. This seems like a good solution at the time, but this quick fix rarely works and often places people in an even more desperate situation. The problem is simple math. You couldn’t make ends meet with your previous take home income. Even though the cash withdrawal provided immediate relief, the long-term effects are quite harmful. Once the withdrawal is made you need to pay back the loan which means that you get less money with each pay. This places you in a situation where you once again need to borrow against your retirement. It is a vicious circle that you want to avoid. Debt Settlement and Professional Debt Negotiation While there is no escaping the hard choices that come with reducing expenses and good money management, there is a fast and effective way to help you get out of debt without filing bankruptcy. This is debt negotiation, also called debt settlement. The goal is to get you out of debt in a few years while paying back about half of what you owe. This is accomplished by having a professional negotiator acting on your behalf who eliminates the harassing calls and sets up a payment plan significantly lower than your regular monthly payments. While your credit does take a hit at the beginning of the program, most people watch their credit rise back up by the end of the program to a point where they can get a house or a car at a decent interest rate. Learn more on our Debt Negotiation page. You can take charge of your financial future and get out of debt while avoiding bankruptcy. It just takes a little help from the legal professionals at Harold Shepley & Associates, LLC. Find out what options are available for you. Call us today at 877-827-9006, or complete our easy to use Contact form. We’re ready to help.

So, You have Received a Collection Letter

Hearing from a Collection Agency Receiving a letter from a collection agency or attorney can be very intimidating. A collection letter may be written in a very friendly manner — ”Welcome to ABC Collections, we look forward to serving you and helping you determine which option works best for you to manage your debt.” Collection notices can be very threatening — ”If you do not pay the balance in full within thirty days, we will file a lawsuit to collect the debt from you.” Whichever one you receive (and you may receive both types), the goal for the collector is the same: to get a payment from you. The placement of a debt with a collection agency or servicer means that your primary creditor has exhausted their in-house attempts to collect the debt. Before the collection agency became involved, those efforts usually started with multiple letters and phone calls. Once your creditor decides that their attempts will not yield payment, they either sell your account to a third-party collector, or hire a debt collector to make further attempts at collection. Collectors can be companies or attorneys. As collectors, they must all follow the Fair Debt Collection Practices Act (FDCPA) and the Pennsylvania Fair Credit Extension Uniformity Act (PFCEUA). These laws protect consumers from over burdensome debt collection actions, such as telephone calls after 9 pm, threats to take any action they cannot legally take to collect a debt, falsely identifying themselves as a government agent, or communication via postcard. It also forces any attorney or company to identify themselves as a debt collector either orally during a telephone call or in writing in any written communication. Can a Collection Letter Lead to a Lawsuit? Receiving a collection letter can be considered the first step in the collection process that could lead to a lawsuit being filed against you to collect the debt. A collection agency from whom you have received a letter will typically turn the file over to an attorney if they are unable to acquire a payment. The attorney may send their own collection letter in an attempt to get payment before filing a lawsuit. These letters must also comply with the FDCPA and PFCEUA regulations concerning debt collection. Once a lawsuit is filed against you to collect a debt, your options become limited as to how to deal with the debt. You can learn more by reading our article Served with a Lawsuit? If you receive a collection letter, please don’t ignore it. The problem will not go away! This letter may be the first sign that you are not able to manage your current debt. Many people receive a collection letter and call the collector to make payment arrangements that they cannot afford. If you are unable to pay the debt for any reason, you should consider debt negotiation or bankruptcy. Find out what options are available for you. Call us today at 877-827-9006, or complete our easy to use Contact form. We’re ready to help.

Should a Christian File for Bankruptcy?

God and Debt. Is There a Christian Debt Solution? There is a belief “out there” that people in debt are bad, irresponsible, ignorant, stupid, or uncaring people. Many of those who hold this belief are the debtors themselves. Every day, we talk with people that are embarrassed and ashamed. They feel like they have let their families, their friends, and society down. They feel like they have failed, and that they will never recover. Unfortunately, these feelings often delay the help they truly need. These feelings of debt and of wondering if it is a sin to be in debt, keep them trapped in a reality that tortures them daily. It affects their relationships and can often cause marital distress leading to divorce. These fears, false evidence appearing to be real, cause unnecessary stress that can easily be remedied by seeking a solution. These false assumptions come from a variety of areas. The biggest hurdle people must overcome is that they are not the only person to ever be in debt. We tell our clients that at least half of their friends and family members have filed bankruptcy in the past. They just don’t know. In this social media world, everyone wants to share their triumphs and rarely their disappointments. At Harold Shepley & Associates, LLC, we are Pennsylvania Bankruptcy Lawyers with a Christian perspective. Learn more by visiting our Bankruptcy page. Debt Forgiveness has Biblical Roots There is also the thought that they have let God down and are somehow beyond redemption. If they only knew that bankruptcy had its roots within the Jewish heritage, then maybe they wouldn’t feel quite as bad. Back when Jesus walked the earth, the Jewish people celebrated the Festival of Jubilee every 7 years. All debts were forgiven between one person of Jewish faith and another person of Jewish faith. The idea is that God doesn’t want you to be held captive by debt or anything else. The fact is that we make bad decisions every day that affect our relationships with God and the people around us. God is willing to forgive these sins if we simply ask for forgiveness. You see, God is more interested in His relationship with you than any false front that you may portray. He has even offered the Festival of Jubilee in the past and now offers debt negotiation or bankruptcy in the present to deal with debt. The choice to escape debt is up to you. Isn’t it time that you stepped out of your problem and into a solution? Harold Shepley & Associates, LLC can help get your financial world back on track. Call us today at 877-827-9006 or schedule a FREE consultation online. We’re here to help.

Credit Report Errors

How Your Credit Report Affects Your Life Your credit report has so much more to do with your life now than it used to. For good or bad, your credit score can influence the rates of loans you are offered, security clearances, job applications, and even the cost of car insurance. It’s more important than ever to keep an eye on your credit report for: Inaccurate information Obsolete information Outdated information Unverifiable information According to the FACT ACT you are entitled to a free credit report once every 12 months. You can order your report via phone, mail, or online by simply going to Annual Credit Report.com. Fixing Credit Report Errors Once you receive your credit report, look it over carefully for mistakes and file a dispute if you find incorrect information. The agencies will provide the information you need to file a dispute based on how you got your report. You can dispute it online, or if you ordered it via mail or phone, they will send a dispute form along with your credit report. You can also hire a professional company to do it for you; just be sure any firm you hire adheres to Credit Repair Organization Act before you start any kind of credit restoration. Remember – credit agencies are private companies and not government entities as many presume. The agencies make their money buying and selling your information. The information they get is provided to them via: Creditors Loans you have obtained Public records Credit applications you have filled out There have been numerous news articles about the high percentage of Americans that have legitimate errors on their reports, and those numbers are alarming. It would be most wise to take the time to order your report – or at least sign up for one of the several free monitoring services that are available online, like Credit Karma. Monitoring your credit report, keeping it accurate, and working to build a good credit score can help you succeed in life. Start by getting your credit report and follow up if you see any problems. Do it today! Why Choose Harold Shepley and Associates, LLC? At Harold Shepley and Associates, LLC, we have the experience to deal with debt situations of all kinds. We are a full service Law Firm that is client-oriented and will work hard to meet your personal financial needs. Call us today at 877-827-9006, or complete our easy to use contact form. We’re ready to help.

The Envelope System

Handling Household Expenses without Credit Cards Want to reduce your credit card debt? Try the Envelope System. Credit cards are easy to use, too easy! You swipe them, sign them, and forget them! Then you try to put those charges out of your mind until the credit card statement comes. When you open that bill and look at the interest, you realize you’ll be paying that purchase off for years, if not for decades! One of the oldest, most time-honored ways of reducing credit card debt is called the Envelope System or Envelope Method. It’s simply a hands-on system that keeps you accountable for what you spend. As the name implies, you assign an envelope to each item in your family’s budget. On the outside of the envelope, put the budget item name, the amount that you owe, and the due date. When you get paid, put the money in the envelope. When the bill comes due for that item, pull the money out of the envelope and pay it. An Example of the Envelope Method How it works: You get paid twice a month and have a budget of $500/month for groceries. On your envelope, write “Groceries – $250.” From your first pay, you would put $250 in the envelope. The money in this envelope goes for groceries only. When you go to the grocery store, take the envelope with you. You spend no more than the money inside of the envelope. If there is more than $250 worth of groceries in your cart, things will have to go back. To stay in budget, you can purchase items on sale or off brand products. You will get to spend another $250 on groceries after your next pay. Use the Envelope System for “everything” in your budget, such as: groceries, phone, restaurants, entertainment, gas, clothing, insurance, taxes, etc. When your money runs out, there is no more money to spend until the next month. Don’t cheat and borrow from other envelopes. If you have money left over in an envelope, put it in an emergency fund envelope for a “rainy day.” If you find that your monthly income is not enough to cover all of the envelopes, you will need to cut back on things. Spending more money than you make is the surest way to find yourself deeper and deeper in debt. Until you can increase your income, you may need to be very careful about your purchases, even look for lower cost housing and transportation if necessary. Credit cards are a great convenience, but they also create a situation where it is far too easy to spend money that you do not have. The Envelope System brings you back to reality, where you budget realistically for the things you need and save for the things you want. Why Choose Harold Shepley and Associates, LLC? At Harold Shepley and Associates, LLC, we have the experience to deal with debt situations of all kinds. We are a full service Law Firm that is client-oriented and will work hard to meet your personal financial needs. Call us today at 877-827-9006, or complete our easy to use contact form. We’re ready to help.

Top 10 ways to Budget for Holiday Spending

Smart Ways to Budget for Christmas The holidays are almost here! You’ve been busy all year, and now your pre-holiday panic is starting to set in. It’s time to buy gifts, plan parties, and even travel back home to be with family. What will it all cost? A happy holiday season starts with a smart budget and using a creative mindset to avoid being caught in credit card debt that will last for years. Here are a few great Holiday Spending tips: 1. Determine what you can afford to spend. Look over your finances, and determine how much you can afford to spend on gifts and other expenses this holiday season. Set this figure as your overall holiday spending limit. 2. Set a spending limit for each area of your holiday budget. Run through your list of holiday expenses (gifts, decorations, holiday food, etc.) Set a budget for each area of spending. 3. Track your spending throughout the season. Keep a running total of your purchases on a worksheet. Don’t panic if you overspend in a category, just scale back your spending in another category to make up for it. 4. Make a list whenever you go Christmas shopping. Make a list and check it twice. Don’t leave home without it. 5. Use coupons and discounts, but only for the things you need. Coupons are a great way to save money but only for the things on your list. You are not saving money when you buy things not on your list – even with coupons. 6. Don’t forget homemade gifts. Most people will not only understand your efforts to avoid debt, they will admire your efforts. Believe it – they would rather have your great home-baked brownies over $20.00 worth of fancy soaps. You’ll find over 1,000 handmade gift ideas on Pinterest alone! 7. Make a list of every person you will be buying for. Get a box of envelopes. Create an envelope for everyone on your list, with a name and dollar amount on the envelope and the cash inside. This is a great way to keep your Christmas spending under control. 8. If you can’t afford to pay cash, DON’T BUY IT! There is no reason you need to go into debt to provide a gift for someone, no matter how much you love them. Credit card debt is frightening, because the interest compounds monthly. That means that if you make the minimum payments, it could take 30+ years to pay off your Christmas purchases! 9. Set up a Christmas savings club. Talk to your bank or employer about starting a Christmas Savings Club. Putting in as little as five dollars a week adds up quickly when buying for the holidays. You’ll feel so much better paying with cash you saved than a credit card that will haunt you for years! Be smart, stick to your budget and avoid credit card debt. One of the best presents you can give yourself this Christmas is to arrive in the New Year DEBT FREE! Why Choose Harold Shepley and Associates, LLC?

Are You Dependent on Credit Cards?

How do you know if you have developed an unhealthy dependency on your credit cards? Do you find yourself… Saying things will get better next month. Catching up on your bills with your bonus from work. Using your tax return to pay off bills. Day dreaming that your credit cards will be paid off someday. In our electronic age, credit cards can be a great convenience. They allow you to shop and even purchase big ticket items without carrying around a money-belt full of cash. Credit cards allow you to buy online and receive your purchase at your doorstep within days. Credit cards, however, are not a good way to finance your lifestyle. Do you find yourself using your credit cards every month to buy basic necessities like groceries and gas or to pay your utilities? Do you see your minimum payments increase because you cannot stop using your credit cards? Are you continually searching for cards with 0% interest so that you can do a balance transfer with a lower monthly payment, only to do another balance transfer six months later? Are you caught in one of these vicious cycles? Credit Card Debt Leads to Bad Credit If you are reading this saying “Yes, this is me!,” then it’s time to get help. Credit card debt can quickly become overwhelming, piling up out-of-control, leading to a bad credit score and damaging your financial future. Harold Shepley and Associates can Help Harold Shepley & Associates, LLC can provide you with the financial freedom you are looking for. With our Debt Negotiation Program, we can settle your credit card debt while providing you with an affordable monthly payment. Imagine being able to buy groceries and gas without having to use your credit cards!

How to Find a Good Debt Relief Attorney

How to Find a Good Debt Relief Attorney Finding a good debt relief attorney is the most important step you can take in achieving freedom from overwhelming debt. Focus your efforts on finding a lawyer who deals with your specific issue and one that will be there for you, helping you through the whole process from start to finish. Communication is also very important when looking for an attorney. You want to find one that returns your calls. Pay particular attention to the chemistry between you and the lawyer you are considering. If you feel uncomfortable with that person during your first few meetings, you may never achieve an ideal lawyer-client relationship. Trust your instincts. What Type of Attorney do I Need? You want to find a debt attorney who has specialized expertise in this area and experience with bankruptcy. It is also a good idea to find an attorney familiar with the courts and laws of the area in which you live. This will enable the attorney to represent your best interests. Contact the Bar Association Your state bar association keeps public records about complaints and disciplinary actions taken against attorneys licensed to practice in the state. You can visit the Lawyer Referral Directory of the American Bar Association to being your search for an experienced debt attorney in your state. Also review online directories of attorneys that offer free reviews, including but not limited to AVVO.com and LawyerRatingz.com. Get Recommendations from your Family, Friends & Employer Talk to friends, family members, and people in your community who have used an attorney. Find out who they hired and what type of service they offer, and if they were happy with the services provided. Another resource is your employer. Ask if your employer offers discounted legal services through either a specialized program or an EAP (Employer Assistance Program). For example, if your EAP offers a free 30-minute legal consultation, you can use that time to figure out if bankruptcy or debt negotiation makes sense for your situation. Make a list of potential attorneys that practice in or around your location. This will help you eliminate some attorneys and choose others that might be right for you. Review Each Attorney’s Website You will want to check for specific information on the practice areas of the attorney. Also look for background information such as his or her law school. Review each attorney’s website for general information about the type of legal issue you may need help with, including frequently asked questions or blogs with articles pertaining to your debt or legal issue. The best attorneys will maintain well developed websites offering informative content. Most attorney’s websites will provide information about each attorney working for the firm, including their educational background and work history. Typically, you should look for an attorney with at least 3 to 5 years of experience practicing the type of law with which you need help. Many attorneys may also use social media such as Twitter, LinkedIn, or Facebook. Check out these profiles as well. How an attorney conveys himself/herself to the public may help you get a sense of how well you would be able to work with them, as well as how comfortable you would be having the attorney assist you professionally with your needs. Harold Shepley and Associates can Help At Harold Shepley and Associates, LLC, we have experience dealing with personal debt. We are a full service law firm that is client-oriented and will work hard to meet your needs from debt negotiation to bankruptcy. Call us today at 877-827-9006, or complete our easy to use contact form. We’re ready to help!

Successful Savers & Investors

Successful Savers & Investors Saving money and investing takes time and persistence. You need to be in control of your personal debt and living within your means. It’s not easy, and you may feel overwhelmed. To have money in your budget each month for savings and investment goals takes an ongoing financial commitment. How do I make a Financial Commitment Stick? You need to set aside today’s money for your future goals. Successful savers think ahead. They don’t just live for today, but they plan for tomorrow. They put their income toward saving and investing goals that are important to them. Savings goals include: Major purchases, including car and home Your children’s education Retirement savings Emergency expenses Stick to your Savings Goals A key to successful saving and investing is being consistent. Stick to savings and investing month after month and year after year. Make saving a staple in your monthly budget and know that it is an essential part of meeting your future financial goals. Plan for Financial Emergencies Successful savers and investors know that financial emergencies happen. Your car may need repaired, the water heater may break, or an unexpected health crisis may occur. You need to set money aside so that you are not in a bind when unforeseen circumstances happen. A good rule to follow is to have three to six months of living expenses saved in an emergency fund. Having a few thousand dollars tucked away in a savings account can make a big difference if a large financial expense would occur. Pay Yourself First Before anything else, make sure money from your paycheck gets put aside for saving and investing. A good starting point is 10%. Depending on your income and other financial commitments some savers and investors are able to save 25% or more of their income. Get into a habit of saving first. Whenever your paycheck is cashed or deposited, move a chunk to a savings account and stick to it month after month. Also consider saving for retirement by joining an employer’s 401K plan and having pre-tax money set aside. Opening an individual retirement account is another good saving and investing option. Live Below your Means If you spend every penny you earn, you will not have the money to set aside for future goals or emergency situations. To be a successful saver, you must spend less than you earn on a consistent basis. The secret to living below your means is buying what you need and not what you want to have. In today’s society we often fall victim to the impulse buying influences in our lives. Retailers want you to believe that we cannot be happy without more stuff! To live below your means is to create a lifestyle you can pay for and have money left over. If you are spending more than you make, you will accumulate debt, making it more difficult to save. You also run the risk of damaging your credit if you overextend yourself on purchases and fall behind on your payments. Borrowing too much money can jeopardize what you could be putting aside for savings and future goals. Harold Shepley and Associates can Help At Harold Shepley and Associates, LLC, we have experience dealing with personal debt. We are a full service law firm that is client-oriented and will work hard to meet your needs from debt negotiation to bankruptcy. Call us today at 877-827-9006, or complete our easy to use contact form. We’re ready to help!

Debt Negotiation

Can I Keep My Home and Car? You were thrilled when you were able to negotiate and settle one of your credit When faced with mounting debt and life changing events like Bankruptcy, it is only natural to feel overwhelmed. What if you lose your car? Will they take away your home? The Debt Negotiation Program at Harold Shepley & Associates, LLC is specifically designed to not only keep you out of Bankruptcy, but also provide you with the peace-of-mind of being able to keep your home and your car. Debt Negotiation will settle your unsecured debt at 60% or less of the balance that you owe; therefore, allowing you to continue to make your monthly mortgage and car payments. How Will Debt Negotiation Benefit Me? Debt Negotiation will allow you to avoid filing for Bankruptcy. Our staff will stop the harassing creditor calls. We will provide you with ONE low monthly payment. You will become debt free in about 3 years. When you first call Harold Shepley & Associates, LLC, you will speak with a certified debt counselor.Our debt counselors will discuss your financial situation with you and come up with a payment plan that is affordable for you. The monthly payment for the Debt Negotiation program is usually significantly less than what you are paying your creditors now. We understand that this can be a very scary step to take and that is why we are with you every step of the way. The staff at Harold Shepley & Associates, LLC will answer all your questions and address all of your concerns. What You Have To Look Forward To After Debt Negotiation After working with us to successfully implement your debt management program, you will become: Financially free of all unsecured debt Living on a cash only basis Having a budget in place to remain debt free If your financial burdens are weighing you down and affecting your life, it is time for you to call Harold Shepley & Associates, LLC for your free consultation. Isn’t it time that you stepped out of your problem and into a solution? You have nothing to lose but your debt! Harold Shepley and Associates can Help At Harold Shepley and Associates, LLC, we have experience dealing with situations of both Debt Negotiation and Bankruptcy. We are a full service law firm that is client-oriented and will work hard to meet your personal needs in resolving debt. Call us today at 877-827-9006, or complete our easy to use contact form. We’re ready to help!

1099-C – Cancellation of Debt Notice

1099-C Cancellation of Debt Notice You were thrilled when you were able to negotiate and settle one of your credit card accounts for much less than the full balance. Your debt relief efforts were showing results! Unfortunately, that thrill turned to anxiety and indignation when you received a 1099-C Cancellation of Debt notice from your creditor during the next tax season. To the government, your forgiven debt is now taxable income! The IRS automatically views any amount of forgiven debt as taxable income, but there’s no immediate reason to panic. If you are able to show that you qualify for an exemption or an exclusion, as many do who are in your situation, you can often avoid paying taxes on this imputed income. It’s probably natural to feel that a 1099-C is somehow punitive. After all, if you couldn’t afford to pay the debt that triggered the form, how are you supposed to afford to pay taxes on the “income” the form represents? The 1099-C exists because many unscrupulous people over the years have found ways to use debt forgiveness to avoid paying taxes. Also, there is the general idea that if you don’t have to pay something that you legitimately owed, then you are receiving a financial benefit that should be taxable. Unfortunately, when the cancellation involves consumer debt, it invariably involves a balance significantly inflated by fees and interest charges, so the real financial benefit of the cancellation can be called into question. You might also question the motives of the creditor who issued the 1099-C, but this isn’t just a nasty, backhanded way for them to penalize you for settling the debt, and it’s also not something that can be negotiated away as part of the settlement process. In fact, the IRS has a list of circumstances that, when they occur, require the creditor to issue a 1099-C, and you may receive one in a variety of situations that do not directly involve settling a debt. How to Handle Your 1099-C and Taxable Debt No matter what, you can’t just ignore your 1099-C and hope nothing happens. First you need to examine it to make sure the information actually applies to you and, if so, that it’s accurate. It’s entirely possible that the creditor has made one or more mistakes that will need to be corrected. It is also possible that the 1099-C you receive will be dated for an event that happened in a prior year, or for the current year but after you have already filed your tax returns. In every instance you need to make sure to give your tax preparer a copy of the form. You should also confirm that they are familiar with cancellation of debt issues. While it depends on the specifics of each situation, seeking the exemption will often involve filing IRS Form 982 and completing the appropriate worksheets. If your particular tax preparer isn’t familiar with this process you should be able to find someone who is – millions of 1099-C’s have been issued in recent years and the need to deal with them has become much more common as a result. Finally, if you are someone who tries to save money by preparing your own taxes and you encounter an issue with a 1099-C, it’s important to realize that the details of this area can be somewhat complex and difficult to understand. It’s always better to seek professional help rather than deal with the potential consequences of mishandling your filing. Harold Shepley and Associates can Help At Harold Shepley and Associates, LLC, we have experience dealing with situations of personal and household debt every day. We are a full service law firm that is client-oriented and will work hard to meet your personal needs in resolving debt. Call us today at 877-827-9006, or complete our easy to use contact form. We’re ready to help. There is no reason financial stress should ruin your life. Talk to our debt relief specialists, the consultation is free. Call us today at 877-827-9006 or use our easy-to-complete contact form. Our attorneys will be delighted to speak with you.

Creating a Monthly Budget

A Monthly Budget Worksheet can Help When it comes to getting your personal debt under control, a good place to begin is with the basics of a household or personal budget. Creating a monthly budget helps you identify where you may be overspending and can also help you in developing an overall financial plan. Building a budget should start with a review of your check book register and bank statements. Look for the recurring expenses that happen every month or every quarter. Things like rent, utilities, and transportation are only a part of your ongoing expenses. You may be surprised at how the daily trips to the convenience store or eating out for lunch can really add up. Once you know what you are actually spending, you will be able to set up a monthly budget template as a guide to follow in keeping your expenses under control. You may find that once you have a budget in place and more awareness of your spending habits, you will make some changes to your behavior that assure you will have more money left at the end of the month. For your convenience we have attached a link to a budget worksheet that you can print for your personal use. At Harold Shepley & Associates, LLC, we are full service debt relief law firm, and we’re here to help. Call us today at 877-827-9006, or visit our Contact page for your FREE consultation. Monthly Budgeting Tips When budgeting for utilities you may find it is easier to set up a monthly budget based on the yearly expense. Some utility companies will set you up on a budget plan that will average your yearly expense and set a monthly payment that remains the same throughout the year. Remember, when setting up a monthly budget to include expenses such as Christmas, birthdays, holiday spending, and vehicle expenses. It is important to set aside money each month so when the time comes you will have the money to buy gifts or buy tires for your vehicle. Building an emergency fund should be a priority over expenses such as dining out or entertainment. Having an emergency fund can be the difference between falling behind on your mortgage and paying for groceries if you were to have an accident or medical issue that would prevent you from working for a short period of time. You may find it helpful to have a separate savings account to deposit the money into and one that is not connected to your debit card and easily accessible. After you have a budget in place and an emergency fund set up, it is time to think about saving for retirement and children’s college funds. The earlier you start, the more you will be able to save. If you receive a tax refund or a yearly bonus at work, you can deposit it into either fund to help offset the monthly expense of your savings effort. Harold Shepley and Associates Can Help If you’ve fallen behind on your payments and your efforts to create a monthly budget simply serve to highlight the difficulties of your situation, it may be time to get professional help. At Harold Shepley and Associates, LLC, we have experience dealing with situations of personal and household every day. We are a full service law firm that is client-oriented and will work hard to meet your personal needs in resolving debt. Call us today at 877-827-9006, or complete our easy to use contact form. We’re ready to help.

Does Debt Consolidation Work?

Be Careful – You Cannot Borrow Your Way Out of Debt! If you’re reading this, it’s likely you’ve been researching ways to get out of debt, or to improve your financial situation with regard to debt. In this article, we’ll consider how debt consolidation works. To begin, let’s start with the basics, like the difference between debt consolidation and debt negotiation. Debt Consolidation refers to the act of grouping all your outstanding debts into one single debt, making payments more manageable as you work to reduce and eliminate what you owe. Debt Negotiation is when an attorney steps in to negotiate with your creditors and reduce your total debt load. To learn more, visit our Debt Negotiation page. Debt Consolidation Loans Debt consolidation loans are one of the most common solutions people think of when they fall victim to financial hardship. Unfortunately, people who choose debt consolidation often find themselves with a larger debt and in deeper financial trouble than they were before the loan. The reason this happens is that you can NOT borrow your way out of debt. A debt consolidation loan will not reduce the amount you owe. You will pay on the entire principal and will be paying far more interest over a longer period of time. Unfortunately, when you try to consolidate debt, it is often nothing more than a very expensive way to cover up an underlying problem. At Harold Shepley & Associates, we focus on solving your debt problems, not merely covering them up or allowing you to fall victim to so-called solutions that only worsen your situation. To learn more call us at 877-827-9006, or complete our easy to use contact form. We’re ready to help. Home Equity Loans and Debt Consolidation When taking out a debt consolidation loan, you will most often be required to secure the loan against some form of asset, usually your home. This is called a home equity loan or home equity line of credit (also known as HELOC). You may be thinking: How do I qualify for a home equity loan to consolidate my debt? To qualify for these types of loans you must have a home and you must still have equity in your home. In other words, the value of the home must be worth more than what you owe. Assuming you manage to get a home equity loan, you have now put your unsecured debt into a secured loan. That means you have put your personal assets at risk. If you run into further difficulty paying on the new loan, you run the risk of a foreclosure on your home. Personal Secured and Unsecured Debt Consolidation Next, we’ll review unsecured consolidation verses secured consolidation loans. When you put something up that you own (such as a car, property, home, computer, TV etc.), your turn your debt consolidation into a secured loan. This is to provide collateral if you fail to make payment to the loan company. If you take out an unsecured loan, you do not put up any collateral on the loan. However, this type of loan has a higher interest rate and often comes with hefty penalties if you do not pay on time. With both types of consolidation loans, you run risks. There is the risk of losing your collateral if you are unable to pay on the new loan and the risk of going even deeper into debt if your loan is unsecured. Credit Card Balance Transfer Another way people consolidate debt is through credit card balance transfers. If you are struggling to pay credit card debt and other bank loans, credit card companies try to attract new customers by offering zero or a low-percent interest on balance transfers. Ideally, you want to transfer balances from credit cards with high interest rates into a card with one these offers. Transferring balances can help short term, as long as you carefully keep track of the promotions and the end date when the interest rate will substantially jump. The promotions are to entice you to sign up with the hopes that you forget that the low interest offer only lasts for so long. After the introductory period is over, the rate will increase and so will all the debt that was transferred. Dealing with Debt Successfully When choosing to consolidate debt, you are simply shuffling the debt around so that it becomes easier to pay.While this has some limited value, most of the time you are not fixing the problem. Typically what happens is this: once you consolidate the debt, you discover you now have more spending power. You have credit cards with space to charge and once again you find yourself running your credit cards up to the max. Now you have both a consolidation loan and more credit card debt to pay. If you were having trouble paying your previous debt, how are you going to repay the combination of your new loan and your newly maxed out credit cards? Harold Shepley and Associates can Help You aren’t alone. If you are having trouble paying bills and considering a debt consolidation loan, call us today at 877-827-9006, or complete our easy to use contact form. We’re ready to help. At Harold Shepley & Associations, our experienced attorneys will assist you with real debt relief options, without putting your home and property at risk. We’ll get you out of debt once and for all. We not only eliminate the interest rate, we reduce the actual balance owed to the creditor and arrange for an affordable payment plan. We can do this for clients located anywhere in the United States. So what are you waiting for? Call us today at 877-827-9006.

Chapter 13 Bankruptcy

Don’t Qualify for Chapter 7 Bankruptcy? Consider Chapter 13 Chapter 13 bankruptcy is a payment plan that allows you to pay back some, but not necessarily all, of your debt. Chapter 13 is often a good solution for people who do not qualify for Chapter 7 because their incomes are too high (i.e., above the annual median income for a household of the same size). However, Chapter 13 is not limited to high-income earners. If you are behind on payments to a secured creditor, such as a mortgage lender or car loan provider, Chapter 13 may allow you to keep your car or home. How does Chapter 13 Bankruptcy work? If you can afford to make your current payments and pay any accumulated back payments over a 36 to 60 month period, you can keep your house or car. As the debtor, you must first submit a repayment plan for Court approval. The repayment plan does not discharge your unsecured debt immediately, but allows you to develop a plan to repay secured debt and possibly some or all of your unsecured debt. The repayment plan depends on your income and debt during the 36 to 60 month period. The plan is based on your income and how much disposable income you have remaining each month after paying all essential household bills. An individual, husband and wife, or a self employed business owner with regular income may file a Chapter 13 bankruptcy in Pennsylvania provided your debt amounts to less than $394,725 of unsecured debts and $1,184,200 in secured debts. Interested in learning more? Contact Harold Shepley and Associates today by calling 877-827-9006, or visit our Contact Us page. Under Chapter 13, you have the Opportunity to: Reorganize your situation, possibly reducing certain secured debt, Reducing or eliminating unsecured debt, Surrendering certain assets, Rejecting or assuming certain leases, Removing judicial liens, Requiring utility companies to restore service, Stopping wage garnishments including the IRS, Reducing certain taxes, Stopping certain law suits, and Stopping foreclosures and sheriff sales Another advantage of Chapter 13 is the possibility to modify or totally eliminate wholly unsecured second and third mortgages on your principal residence. You can also attempt to lower the principal balance of a first, second or third mortgage or modify the terms for real estate that is not your principal residence. Also, in certain situations you may be able to reduce the principal balance of your car debt, as well as the monthly payments. Discharge Your Debt, a Fresh Start with Creditors Once you have completed payments under the Chapter 13 plan, the Court will enter a discharge order which will allow you a fresh start with future creditors. This eliminates dischargeable debts, requiring creditors to remove the debts from your credit report, discontinue pending law suits, and dispose of debts as ongoing obligations. Debts NOT dischargeable under Chapter 13 include: All domestic support obligations, Educational loans (except for undue hardship, injury or death caused by a debtor’s operation of a vehicle), Vessel or aircraft if debtor was intoxicated or impaired from use of alcohol, drugs or other substance, Certain criminal fines and restitution, Certain taxes, Debts incurred by fraud, Restitution or damages awarded in a civil action as a result of willful or malicious injury that caused personal injury or death of an individual. Harold Shepley and Associates can Help You aren’t alone. If you need help understanding Chapter 13 Bankruptcy in Pennsylvania, contact Harold Shepley and Associates, LLC. We have experience dealing with these situations every day. We are a full service law firm that is client-oriented and will work hard to meet your personal needs in resolving debt. Call us today at 877-827-9006, or complete our easy to use contact form. We’re ready to help.

Student Loan Debt

Are You Concerned about Student Loan Debt? The student loan industry has undergone major changes and reform since 2009. While private and federal student loans still exist, most borrowers currently have federal student loans through the US Department of Education. One benefit of having federal student loans is that once you graduate from college, you generally have a six month grace period before beginning your re-payment. The six month grace period is intended to give you a little time to get a job and get started on the right foot. It is also enough time to do what is called a Loan Consolidation and lump all of your student loans into a single, loan where the payments may be more manageable. Student Loan Consolidation A loan consolidation brings with it the flexibility or a range of repayment plans. Standard Repayment Plan-you pay a fixed amount over 10 years (up to 30 years for a consolidated loan) Graduated Repayment Plan-you pay a lower amount at first and your payments gradually increase over 10 years (up to 30 years for a consolidated loan) Extended Repayment Plan-your payments can be fixed or graduated with repayment time of up to 25 years. Income Based Repayment Plan (IBR)- your payments will be capped at 10-15% of your income depending on the loans you have and any remaining balance will be forgiven after 20-25 years depending on the types of loans you have. You are required to submit annual renewal documentation to determine your monthly payment for the year. Pay as you Earn Repayment Plan- your maximum monthly payments will be 10% of your income and any remaining balance will be forgiven after 20 years. You are required to submit annual renewal documentation to determine your monthly payment for the year. Revised Pay as you Earn Repayment Plan- your maximum monthly payments will be 10% of your income and any remaining balance will be forgiven after 20-25 years depending on your loans. You spouse’s loans may be considered in the calculation whether you file a joint tax return or file separately. You are required to submit annual renewal documentation to determine your monthly payment for the year. Income Contingent Repayment Plan-your monthly payment will be the lesser of 20% of discretionary income or the amount you would pay on a repayment plan with a fixed payment over 12 years, adjusted according to your income. Any remaining balance will be forgiven after 25 years. You are required to submit annual renewal documentation to determine your monthly payment for the year. Income Sensitive Repayment Plan-your monthly is based on your annual income and you pay up to 15 years and the amount you pay varies from lender to lender. Student Debt Relief If you feel overwhelmed by student debt, there is hope. First, let’s lay some ground rules. As borrower, you NEVER want to get to the point of being in default on a student loan. If you are in default, the lender has the ability to demand the full balance to be paid immediately, and that can cause massive damage to your credit score! If you are unable to meet the demand for immediate payment, the lender can seek legal recourse. They have the ability to contact your employer and garnish your wages up to 15% each paycheck until the balance is paid. They also have the ability to seize any tax return you may have received. In general, you can’t declare bankruptcy with regard to a student loan. Some exceptions do apply, but for the most part it is very difficult to have a student loan discharged through bankruptcy. Be Proactive The most important thing you can do as a student loan borrower is be proactive. Call your lender and discuss these options with them. Whether it be a federal or private student loan, the lenders generally want to work with you to ensure they receive payment. Discuss the above mentioned repayment plans with them and determine which option is best for you. Be aware that the eligibility in each program is determined by numerous facts specific to your personal portfolio. It is important to know your portfolio to determine your eligibility. Since the student loan overhaul began, the user friendliness of the student loan websites and the eligibility determination has become less of a burden on the borrower. That’s good for you, if you know how things are changing and how those changes are of benefit to you. Harold Shepley & Associates Can Help You aren’t alone. If you need help with Student Debt, contact Harold Shepley and Associates, LLC. We have experience dealing with these situations every day. We are a full service law firm that can help with debt negotiation, is client-oriented, and will work hard to meet your personal needs in resolving debt. Call us today at 877-827-9006, or complete our easy to use contact form. We’re ready to help.

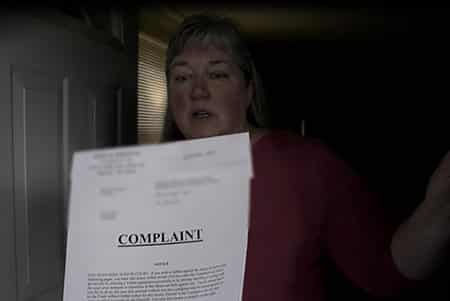

Served With a Lawsuit?

Being Sued – What Should You Do? When the sheriff shows up at your home to serve you with a civil lawsuit, it can be an extremely stressful event. Don’t worry, in cases of a civil lawsuit or other debt related issues, our full service debt relief law firm is ready to stand by your side. Unlike other debt relief companies, we offer the complete services of an experienced legal practice and we can assist you if you receive a lawsuit in connection with your debt. We negotiate and get the best settlement possible for you on your accounts, and we have the ability to put forth any and all defenses you may have in relation to the claim. We will ensure your creditors provide the information they are required to by law and at the same time buy you time to build funds for a settlement. We have been successful getting cases dismissed which result in no liability on you. Contact us immediately upon receiving a lawsuit as there are time sensitive deadlines we need to meet to protect your interests. Call 877-827-9006 today. We’re ready to help. Why did I Receive a Lawsuit on this Account? We have been working on behalf of people just like you for many years. Over all that time we have not been able to pinpoint an exact reason why the creditor decided to file suit. Every creditor has different policies on when and if they sue and those policies seem to change from year to year. There is absolutely no way to predict or explain why your particular creditor has proceeded in the fashion that it has, but rest assured you are in good hands with Harold Shepley and Associates, LLC. The creditors have thousands of people working for them across the country, you deserve to have us working for you! More information about debt relief is available on our Debt Negotiation page. I Received a Lawsuit. Why Should I Defend it? The decision to defend or not defend is up to you, but without question the best choice is to defend your lawsuit. At Harold Shepley and Associates LLC, our Litigation Department has the experience you need to navigate your lawsuit through the Court System and obtain the best result. We understand the importance of your situation and we keep the cost at a minimum while obtaining the best possible outcome. If you choose to defend we will work to prevent a legal judgment from being entered against you. If you choose to not defend, your account will go to a legal judgment unless a response is formally entered with the Court or you appear for your hearing (depending on which Court your suit was filed in). If your lawsuit goes to a judgment, the creditors have enhanced rights on your account and have the right to move forward on that judgment. That is why you should contact Harold Shepley and Associates, LLC and defend any and all lawsuits you may receive. here is no reason the stress of a lawsuit should ruin your life. Talk to our debt relief specialists, the consultation is free. Call us today at 877-827-9006 or use our easy-to-complete contact form. Our attorneys will be delighted to speak with you. What Can a Creditor Do With a Legal Judgment? As stated above, a creditor has enhanced rights on your account once a judgment is obtained. A creditor, using the Court System, can execute on any judgment they have against you. Typically an execution will result in the creditor finding and placing a “freeze” on your bank account. During this time you may not be able to access your bank account and some of your funds may be garnished. In addition, any judgment against you will result in a judgment lien against any property you own which will place even more power with the creditor. At Harold Shepley and Associates, LLC, we understand the needs of our clients and we work to prevent judgments from being entered against you. This is why we highly recommend you defend any and all lawsuits you may receive. If you currently have a judgment, it is not too late. Contact us and we will provide a comprehensive outlook on your individual situation and help you deal with any debt related issues you may have. Why Choose Harold Shepley and Associates, LLC? At Harold Shepley and Associates, LLC, we have over eleven years of experience dealing with the issues you are currently facing. We are a full service debt relief Law Firm that is client-oriented and will work hard to meet your personal needs in this situation. Yes, there are other companies out there to help, but we truly believe that there is no other Law Firm that so completely meets the needs of people overwhelmed by debt as we do. Not only will we work towards settling your accounts and saving you money, we will serve your legal needs as it relates to any lawsuit you receive or in any other way in which we can provide the best help possible to you. Call us today at 877-827-9006, or complete our easy to use contact form. We’re ready to help.

What is a Judgment?

Has a Civil Action been Taken against You? Judgments are the result of a civil action filed in a court. They are usually for the collection of money owed by one party to another. Civil actions can start only within certain time limits. For example: The time limitation for a written or contract is four years. A contract for the sale of goods is four years. Injury to personal property is two years. Any other action not otherwise limited is six years. Unless specifically agreed upon by both parties, the legal interest rate on a judgment is 6% per year. Money Judgment A money judgment may be enforced against your personal property within 20 years after the entry of the judgment. In these cases you are known as the “judgment debtor” and your creditors are referred to as “judgment creditors.” A money judgment may also become a lien on your real property in any county, after the entry into the record of the prothonotary’s office in the county where the property is located. Such a lien is enforceable for a period of five years which may be revived before the expiration of the five year period. Generally, all of your “non-exempt” tangible or intangible personal property and real property is subject to a judgment by way of a writ of execution. You may claim an exemption of certain personal property from attachment or execution from the payment of debts, but these exemptions are quite limited. Through a writ of execution, your creditors can ask the county sheriff to attach any personal or real property belonging to the creditor. The writ directs the sheriff to put a levy on your property and sell it at public auction to pay for the judgment amount (if the amount is not paid before the auction.) Certain property, such as wages, child support, welfare benefits and Social Security payments cannot be taken. Talking to an attorney about a judgment is critical to preserving your wealth and your rights. Call us at 877-827-9006. Judgments Taken by Default Many judgments are taken by a creditor through default. This means that you failed to respond to the complaint after service or failed to appear at a prescheduled court hearing, even if there are good reasons that the judgment should not be granted (i.e., validity of the debt, improper service, unfair debt collection, etc.). Other judgments can be entered in Pennsylvania by transfer of a judgment from another state. Even judgments by confession can be entered in a commercial non-consumer situation. Regardless of what type of judgment is taken against you, any judgment can be stressful. Often creditors will first attempt to seize your bank account before any other asset. If the judgment debtor has already transacted business with the creditor through a check payment, the creditor automatically knows where the debtor’s bank account is and even knows the bank account number. Once seized, any outstanding checks not paid will be dishonored by the bank resulting in overdraft fees and any future automated money credits to the account will also be seized. What to Do when You are Sued The best approach toward being sued is being proactive. Direct contact with the creditor should be made as soon as you are served a complaint and before judgment is entered. The right attorney who is knowledgeable in debt collection and skilled at negotiation is your best bet. Why Choose Harold Shepley and Associates, LLC? At Harold Shepley and Associates, LLC, we have the experience you need to deal with civil actions, law suits, and judgments over money owed. We are a full service Law Firm that is client-oriented and will work hard to meet your personal needs in this situation. Call us today at 877-827-9006, or complete our easy to use contact form. We’re ready to help.

Mortgage Foreclosure

Do You Need to Move Out of Your Home? When a sheriff appears at your door to serve you with a foreclosure notice, it can be a scary event. A foreclosure complaint & summons is the legal document you receive when a foreclosure lawsuit is filed against you. This happens when your lender sues you for failure to make payments on your mortgage. Faced with this frightening legal document, your first thought is “do I need to move out of my home?” No. Even though a law enforcement officer has served you with a foreclosure complaint, it does not mean that you need to leave your home at that time. Contact a Foreclosure Attorney When a mortgage complaint is filed, what should you do next? The best thing you can do when served legal documents is to contact an attorney right away. What is frightening and difficult for you to follow is an area of law in which our attorneys have years of experience. We know the deadlines that need to be met and how to draft a written response that answers each detail of the lawsuit. We can advise you on your best course of action, whether to admit or deny the allegations in the suit, or to request more information. At Harold Shepley & Associates, our goal is to give you the best chance to save your home. We even offer a FREE consultation to help you navigate the variety of legal options available for you in the case of a mortgage foreclosure. Foreclosure Options Options to help you keep your home might include: Refinance Reinstatement Repayment plan Forbearance plan Modification Bankruptcy Options to walk away from your home can include: Short Sale Deed in Lieu Bankruptcy During your consultation with a Foreclosure Specialist at Harold Shepley & Associates, we take the time to review your financial situation and we will provide an overview of the options available and what might be best for you. We will also provide an overview of the foreclosure process and walk you through every step so that you are not alone during this time. You can learn more on our Mortgage Foreclosure Defense page. When it Comes to a Home Foreclosure – Act Quickly! Be sure to contact an attorney’s office as soon as possible. By trying to handle the lawsuit on your own or waiting too long to call an experienced attorney, you are limiting the options that are available to you. Harold Shepley & Associates Can Help Need help with a mortgage foreclosure complaint? At Harold Shepley and Associates, LLC, we experience dealing with these situations every day. We are a full service law firm that is client-oriented and will work hard to meet your personal needs in resolving debt. Call us today at 877-827-9006, or complete our easy to use contact form. We’re ready to help.

Budgeting Tips for a Great Vacation

Going on Vacation? Budgeting Tips for a Great Vacation Going on vacation this year? Vacation planning is essential both to ensure that you have a good time and to keep your vacation budget under control. Don’t spoil the great memories of your get-away by ending up with higher household debt. Here are some vacation tips to help you save money and avoid the debt trap. Start early by making small adjustments to your everyday life that can result in a big impact on your travel funds. Open a dedicated vacation account. Most savings accounts can be opened with a minimum deposit. Some places of business offers a vacation club with automatic deductions from your paycheck. If you put just have $14.00 a week set aside, you will have $750.00 by the end of a year. Start a change jar. Dropping change from your pockets into a jar adds up quickly. The power of pocket change could add several hundred dollars to your vacation fund over the course of the year. Have a garage sale. Like all of us, you probably have things you don’t need, from old books and CDs to unused electronics and more. Plan an old-fashioned garage or yard sale, or learn to sell on eBay and Amazon. Use the funds for your vacation. This trick will also clean up unused items sitting around your home. Put your tax refund to use. If your tax refund is not already targeted to pay down debt, treating it like free money to help fund your vacation is not a bad idea. Vacation Planning Take advantage of off season discounts. Plan your destination and think about selecting certain times of the year for your vacation. Try to avoid traveling around holidays. In some cases, the price could be double at these times. Search for the best deals on Hotels, Resorts, and locations. Sign up for email alerts from travel companies and airlines that share flash sales and limited-only time offers. Hotel Amenities & fees. You want to know exactly what is and is not included in your hotel stay when planning your vacation budget. Be sure to check whether your rates including refrigerator, pools, internet fees, resort fees, parking, complimentary breakfast, laundry service and taxes, which can vary depending on location. Food expenses and drinks. Food and drink costs can add up very quickly. Buy your food and drinks at a local market. Pack food that does not need refrigerated. Avoid buying food that can melt or spill in cars. At theme parks, purchase a cup that can be refilled. Consider an all-inclusive trip. This will help you keep costs down throughout the vacation, as your meals and drinks will already be paid for. You can be very creative in saving for vacation and effective in planning an affordable trip. At Harold Shepley and Associates, we wish you all the best with your vacation travels this year! Harold Shepley and Associates can Help Need help with situations of debt and bankruptcy? At Harold Shepley and Associates, LLC, we have the experience you need to deal with situations of debt relief and bankruptcy consultation. We are a full service Law Firm that is client-oriented and will work hard to meet your personal needs in resolving debt. Call us today at 877-827-9006, or complete our easy to use contact form. We’re ready to help.

Repaying Family Before Filing Bankruptcy

Does Borrowing Money from Family Complicate Bankruptcy? When it comes to filing for bankruptcy, many people have first gone to family for help as their financial problems mount. If you’ve taken a family loan or otherwise received financial help by taking money from family – but your situation has only worsened – what should you do when it comes to bankruptcy? Should you make an attempt to pay your family back before filing? Bankruptcy and Family – the Short Answer There is no advantage in repaying a family member a significant amount of funds shortly before you file for bankruptcy relief. All creditors must be notified when a bankruptcy case is filed and the creditors must be treated fairly. If you decide to repay a family member shortly before you file your case, then you have chosen to treat that particular family member, who is actually a creditor, better than other similarly situated creditors. Consider the following example. Parents choose to lend $3,000.00 to their daughter hoping that it will help her take control of her debt. We will also assume that the parents did not require the daughter to post any collateral for the loan. Despite her best efforts, the daughter is unable to settle her accounts with her creditors. The daughter decides to file for bankruptcy relief. She thanks her parents for the financial help and repays the $3,000.00 with the tax refund that she received in February. Then, she files her case in March, just one month later. What the daughter does not realize is that her parents will be negatively impacted by her good intentions. Why Family Members are Affected When You File Bankruptcy In most consumer bankruptcy cases, a family member that loaned money to you is considered a general, unsecured creditor. In our example above, if any money is available for distribution during the daughter’s bankruptcy case, the parents will receive their proportional share of the money. The parents must be treated the same as the daughter’s other general unsecured creditors – typically credit card companies and medical providers, for example. The daughter’s repayment to her parents during the one-year period preceding the date when she files her case is considered a preferential transfer. The court and trustee will view the daughter as preferring to transfer money to specific creditors before filing her case rather than treating all of her creditors fairly within a bankruptcy case. The Law When it Comes to Bankruptcy and Family Loans The United States Bankruptcy Code specifically authorizes the Trustee assigned to a bankruptcy case to claw back the monies that a person pays to a family member within the one-year period prior to the date when the bankruptcy case is filed as long as the aggregate amount repaid totals $600.00 or more. Reference: Chapter 5 – Creditors, The Debtor, and the Estate, Subchapter III – The Estate. In our example here, the Trustee will likely sue the parents, acquire the $3,000.00 and distribute funds proportionally to the general, unsecured creditors. Reference: Chapter 7 – Liquidation, Subchapter II – Collection, Liquidation, and Distribution of the Estate The policy behind the Bankruptcy Code is to prevent one creditor from grabbing a chunk of the cash funds from an individual before any other creditors. This promotes a uniform, fair method to address consumer debt. Help Family Members Understand Your Bankruptcy Family members that have provided you financial assistance are the last people that you want a bankruptcy case to negatively impact. You may be thinking: How do I explain to my family member that I cannot repay the money I borrowed right now? Explain to the individual that you may repay the money that you borrowed after your bankruptcy case is closed. If you repay the money that you borrowed shortly before the case and the Trustee claws back those funds, you and your family member will lose those hard-earned funds. And, if you still want to repay the family member, it will now cost twice as much if you make the same error that the daughter made in the example above. Bankruptcy, Family, and The Bottom Line Speak with our Harrisburg, Pennsylvania bankruptcy attorneys. Call 877-827-9006 today. Remember, we want to help and the consultation is free. Make sure that you have truthful conversations with your attorney when you have a consultation and during the period when your case is being prepared. If you repaid a family member or friend, inform your attorney. Our attorneys can advise you how a preferential payment can be addressed with your circumstances. Your family may have helped you in the past, now help your family avoid a negative impact by carefully planning how you file your bankruptcy case. When it comes to repaying family before bankruptcy, contact us before taking any action. There is no reason financial stress should ruin your life. Talk to our debt relief specialists, the consultation is free Call us today at 877-827-9006 or use our easy-to-complete contact form. Our attorneys will be delighted to speak with you. Harold Shepley and Associates can Help Need help with situations of debt and bankruptcy? At Harold Shepley and Associates, LLC, we have the experience you need to deal with situations of debt relief and bankruptcy consultation. We are a full service Law Firm that is client-oriented and will work hard to meet your personal needs in resolving debt. Call us today at 877-827-9006, or complete our easy to use contact form. We’re ready to help.

What is Debt Negotiation?

Negotiating a Settlement with Your Creditors When you find yourself overwhelmed with debt, bankruptcy is not your only option. Debt negotiation can be a powerful tool to reduce and eliminate debt over time, improve your credit rating, and get your financial situation back on course. It is often possible to negotiate a settlement for less than the full balance owed. Our law firm typically negotiates settlements at 60 cents on the dollar with fees included. You pay our firm one monthly fee, a payment that grows in an escrow account for the settlement of your debts. Our goal is for your new monthly payment to be less than all the minimum payments you are currently making to your creditors. While there are many debt settlement companies to choose from, having the power of an experienced law firm on your side can make all the difference. At Harold Shepley & Associates, we have the experience to help you reduce your debt, negotiate a settlement, and avoid bankruptcy. Call us today at 877-827-9006 or use our easy-to-complete contact form. More information is available on our Debt Negotiation page. Why enter a Debt Negotiation Program To avoid filing for Bankruptcy You have received a lawsuit from one of your creditors You are falling behind on your monthly payments You able to make only the minimum payments on your credit cards To negotiate a payment lower than all your minimum payments now The most effective way to eliminate debt without filing bankruptcy Stop the harassing collection calls Debt free in approximately 3-3 1/2 years Why Choose Harold Shepley & Associates, LLC? We are a full service Debt Relief law firm. We’ve earned an A+ rating with the Better Business Bureau. No travel is required. We can do everything right over the phone. Our law firm can stop harassing collection calls and pursue legal action for creditors who violate the law. We provide a wide range of debt relief options, including: Debt Negotiation, Bankruptcy, Mortgage Foreclosure Defense, and Litigation Defense. In addition to debt relief, as a law firm representing clients in PA, we can defend against any legal action that has been filed against you. We include all unsecured debt in the program To find your best debt relief solution we offer a free consultation. We have a successful competition rate of over 85% There is no reason financial stress should ruin your life. Talk to our debt relief specialists, the consultation is free. Call us today at 877-827-9006 or use our easy-to-complete contact form. Our attorneys will be delighted to speak with you.

Foreclosure & Mortgage Delinquency