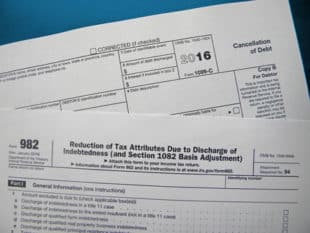

1099-C

Cancellation of Debt Notice

You were thrilled when you were able to negotiate and settle one of your credit card accounts for much less than the full balance. Your debt relief efforts were showing results!

Unfortunately, that thrill turned to anxiety and indignation when you received a 1099-C Cancellation of Debt notice from your creditor during the next tax season. To the government, your forgiven debt is now taxable income!

- The IRS automatically views any amount of forgiven debt as taxable income, but there’s no immediate reason to panic.

- If you are able to show that you qualify for an exemption or an exclusion, as many do who are in your situation, you can often avoid paying taxes on this imputed income.

It’s probably natural to feel that a 1099-C is somehow punitive. After all, if you couldn’t afford to pay the debt that triggered the form, how are you supposed to afford to pay taxes on the “income” the form represents?

The 1099-C exists because many unscrupulous people over the years have found ways to use debt forgiveness to avoid paying taxes. Also, there is the general idea that if you don’t have to pay something that you legitimately owed, then you are receiving a financial benefit that should be taxable.

Unfortunately, when the cancellation involves consumer debt, it invariably involves a balance significantly inflated by fees and interest charges, so the real financial benefit of the cancellation can be called into question.

You might also question the motives of the creditor who issued the 1099-C, but this isn’t just a nasty, backhanded way for them to penalize you for settling the debt, and it’s also not something that can be negotiated away as part of the settlement process. In fact, the IRS has a list of circumstances that, when they occur, require the creditor to issue a 1099-C, and you may receive one in a variety of situations that do not directly involve settling a debt.

How to Handle Your 1099-C and Taxable Debt

No matter what, you can’t just ignore your 1099-C and hope nothing happens.

First you need to examine it to make sure the information actually applies to you and, if so, that it’s accurate.

It’s entirely possible that the creditor has made one or more mistakes that will need to be corrected.

It is also possible that the 1099-C you receive will be dated for an event that happened in a prior year, or for the current year but after you have already filed your tax returns.

In every instance you need to make sure to give your tax preparer a copy of the form.

You should also confirm that they are familiar with cancellation of debt issues. While it depends on the specifics of each situation, seeking the exemption will often involve filing IRS Form 982 and completing the appropriate worksheets.

If your particular tax preparer isn’t familiar with this process you should be able to find someone who is – millions of 1099-C’s have been issued in recent years and the need to deal with them has become much more common as a result.

Finally, if you are someone who tries to save money by preparing your own taxes and you encounter an issue with a 1099-C, it’s important to realize that the details of this area can be somewhat complex and difficult to understand. It’s always better to seek professional help rather than deal with the potential consequences of mishandling your filing.

Harold Shepley and Associates can Help

At Harold Shepley and Associates, LLC, we have experience dealing with situations of personal and household debt every day. We are a full service law firm that is client-oriented and will work hard to meet your personal needs in resolving debt.

Call us today at 877-827-9006, or complete our easy to use contact form. We’re ready to help.

There is no reason financial stress should ruin your life. Talk to our debt relief specialists, the consultation is free. Call us today at 877-827-9006 or use our easy-to-complete contact form. Our attorneys will be delighted to speak with you.